The Meaning and Importance of Your Money Story

The Meaning and Importance of Your Money Story

We’ve all heard that our early life experiences are foundational and shape the way our brain develops. The way we grow, how happy we are, what our future health might be like, how we learn, and our sense of family and community are all programmed through early life experiences. Included in this important era of brain development is our emotional development which shape our neuropathways and how we respond to life’s situations, curveballs, and decisions. We may be taught many skills in early life but we aren’t specifically and intentionally taught how to react.

This is particularly important when you consider the way we react to our financial lives and the money decisions we are faced with throughout the course of lives. The reality is, we don’t get to choose our Money Story. Rather, it evolves from the experiences of the adults in our life during our childhood. Consider:

• Did you grow up rich or poor? Was life a struggle or did you always have what you needed?

• Did your parents fight about money?

• Maybe your parents didn’t talk about money around the kids but kept it a deep, dark secret.

The good news is that we have the option and opportunity to re-write our Money Story and intentionally choose some of the ways we react and respond to money. Some programs and beliefs may be harder to re-wire than others. At Team Duncan Financial, we feel that self-discovery, self-understanding and personal-awareness of our Money Story are essential ingredients to crafting a Financial Life Plan and increase the probability that our goals will be met.

To develop a more positive and enlightened Money Story we may take the following steps:

1. Write down early life money experiences and articulate our money story as it was learned from our parents or important adults in our lives.

2. Explore how these stories and experiences have impacted our beliefs about money.

3. Compare your current beliefs and decide whether or not they support our values and our goals.

4. Consider what would be different if we could re-write our Money Story. How would a new Money Story support our happiness? Our financial goals?

5. What would this mean for our children, our family and our own financial future. What story do we want our own children to hear?

In her book, “The Energy of Money”, Maria Nemeth, Ph. D., offers an exercise with some poignant questions that help us explore and uncover our current Money Story. She challenges readers to write out a “Money Autobiography”.

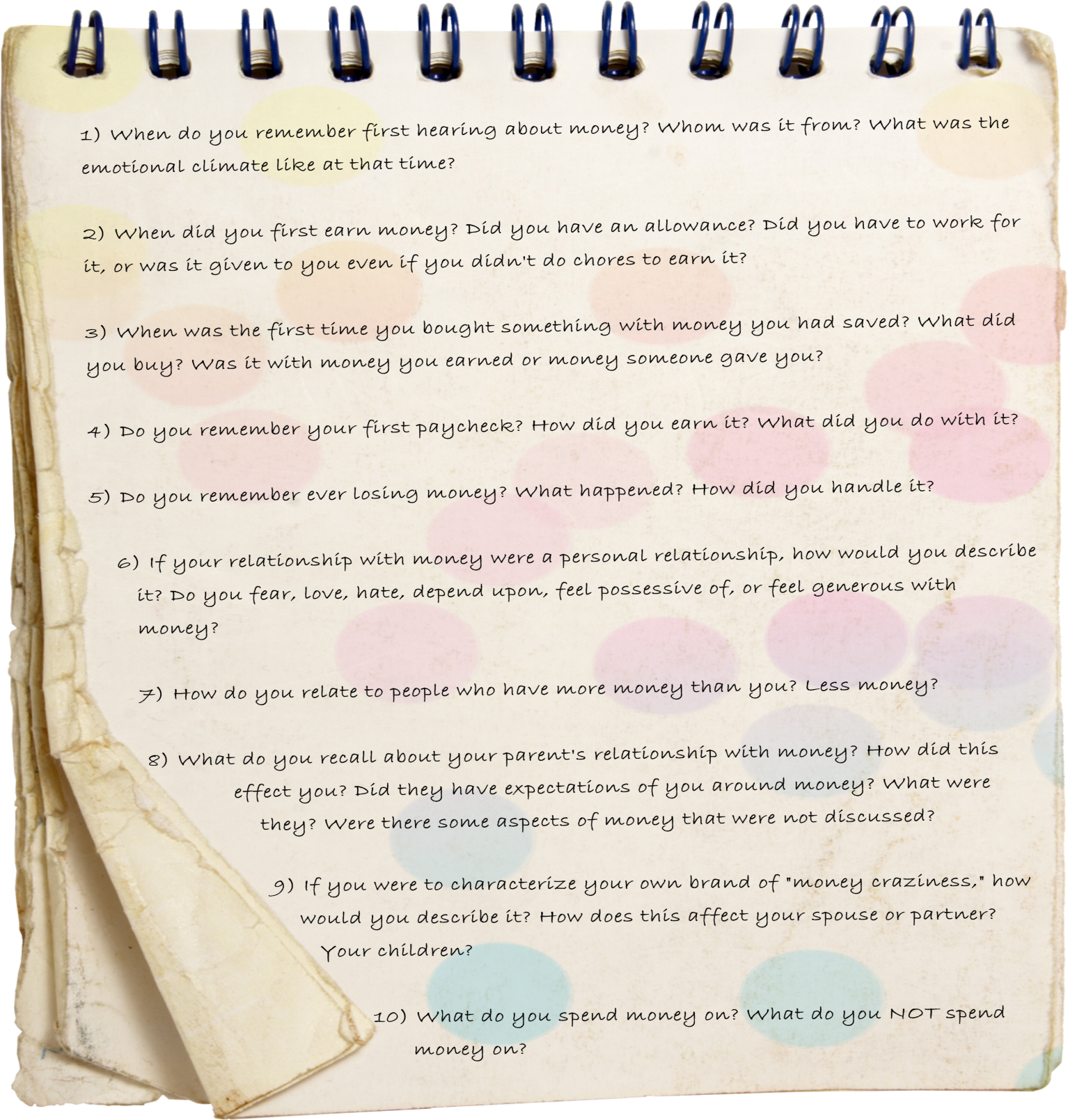

We invite you to explore these 10 questions taken from Maria Nemeth’s “Money Autobiography” exercise. Whether you get out a journal and write this out or simply reflect on and talk with your partner about your own perspective and experiences, your “Money Autobiography” gives important clues about your current Money Story.

Exploring our Money Story in depth and talking about where our reactions and beliefs around money come from is a good way to reduce the risk of being slave to our parent’s Money Story, reactions and experiences. An empowered Financial Life Plan is intentional about diving in and exploring our beliefs, biases and behaviors around the energy of money

—

Moloney Securities Co., Inc. is a Registered Broker-Dealer and Member FINRA & SIPC

Investment Advisory Services offered through Moloney Securities Asset Management, LLC, Registered Investment Adviser

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The information contained in this website is not a complete analysis of every material fact with respect to any market, company, industry, security or investment. Opinions expressed are subject to change without notice. Statements of fact have been obtained from sources considered reliable but no representation is made by Moloney Securities Co., Inc., any of its affiliates or any representative of the company as to completeness or accuracy.

Nothing here should be construed as an offer to buy or sell, or solicitation of an offer to buy or sell any securities.

This communication is strictly intended for individuals residing in the state(s) of AK, AZ, CA, CO, CT, FL, IN, KS, MD, MA, MO, NM, OR, PA, TX, VTand WY. No offers may be made or accepted from any resident outside the specific states referenced.

Moloney Securities, Team Duncan, Financial DNA, https://financialdna.com/

Moloney Securities, Team Duncan, and the tools listed above are not affiliated entities.

IMPORTANT: The projections or other information in the tools listed above are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Your results may not be representative of others. There is no guarantee of performance or success.