Why You Can’t Think Through Financial Decisions

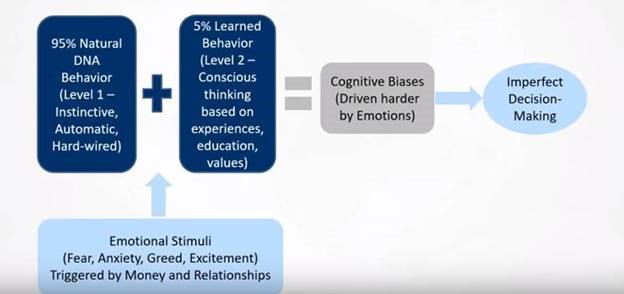

Did you know that conscious thinking drives only 5% of your financial decision making?

Over the years of working through financial pivots with our clients, we’ve learned NOT to assume that our client’s decisions are being made based on rational thought. You may be shocked to find out that thinking through big financial decisions may actually be a waste of time. It is actually pretty unlikely that “thinking through things” is going to factor into the equation a whole heck of a lot.

This is because a person’s Money Personality, or Financial Personality, is made up of primarily unchanging, hardwired, natural behaviors that they are born with. In fact, research shows that 95% of our financial decision making comes from instinctive, Natural DNA Behavior. Natural DNA Behavior drives how we regularly and consistently respond to different events.

The other 5%? That is made up of the Learned Behaviors which are shaped from conscious thinking. Conscious thinking is based on factors like our experiences, education and values.

When we first sit down together to do our Team Duncan Discovery Experience, Eric and I will, most likely, experience a couple or individual through the lens of the 5%, or learned behaviors. If you think about it, most first impressions are thought-out, often calculated and intentional…we want to sound informed, experienced and smart.

The problems may come later down the road. When the Financial Life Plan is in place and clients reach inflection points or big pivots in their lives…when the key financial decisions need to be made… they will revert to their natural behavior style under this pressure. Long story short, the result is that our cognitive biases will then take over, which we’ve seen lead to imperfect decision making and failure to adhere to their Financial Life Plan, time and again.

This is why our co-created, Financial Life Plans are built on a deeper understanding of couple’s Financial Personality. Once each client’s Natural DNA Behavioral Style is explored, we are better equipped to help clients manage their emotions and can communicate the likely consequences of their decisions in a much clearer way. So much can be learned through shining the light of awareness on how we react during times of pressure and stress. This helps us to truly guide and facilitate better financial outcomes for our clients.

We encourage you to explore your Money Personality with us so that we can start a constructive conversation about reaching your inspired goals. You can access the free assessment at: www.teamduncanplan.com. You may also reach out to Eric or me to schedule a time to come in for complimentary Discovery Experience to discuss the results of the Money Personality assessment and learn how further exploration into your Financial DNA may improve the results of your Financial Life Plan

—

Moloney Securities Co., Inc. is a Registered Broker-Dealer and Member FINRA & SIPC

Investment Advisory Services offered through Moloney Securities Asset Management, LLC, Registered Investment Adviser

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The information contained in this website is not a complete analysis of every material fact with respect to any market, company, industry, security or investment. Opinions expressed are subject to change without notice. Statements of fact have been obtained from sources considered reliable but no representation is made by Moloney Securities Co., Inc., any of its affiliates or any representative of the company as to completeness or accuracy.

Nothing here should be construed as an offer to buy or sell, or solicitation of an offer to buy or sell any securities.

This communication is strictly intended for individuals residing in the state(s) of AK, AZ, CA, CO, CT, FL, IN, KS, MD, MA, MO, NM, OR, PA, TX, VTand WY. No offers may be made or accepted from any resident outside the specific states referenced.

Moloney Securities, Team Duncan, Financial DNA, https://financialdna.com/

Moloney Securities, Team Duncan, and the tools listed above are not affiliated entities.

IMPORTANT: The projections or other information in the tools listed above are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Your results may not be representative of others. There is no guarantee of performance or success.