![What to Expect When You’re Expecting [a Financial Plan]](https://www.teamduncanfinancial.com/wp-content/uploads/2018/08/pOz_2018_duncan_branding-042_updated.png)

What to Expect When You’re Expecting [a Financial Plan]

What to Expect When You’re Expecting [a Financial Plan]

We all recognize the value of being financially organized. You’ll be hard pressed to find a person who dismisses the merits of saving for future goals such as your kids’ education or retirement. Many folks agree that it can be advantageous to seek professional help in tailoring your current behavior to align with future goals. However, one key question still pops up when people think of financial planning.

“So, what exactly am I getting when I pay for a financial plan?”

This kick-off question usually leads to follow-up questions. “Is a financial plan, like, a binder with charts and instructions in it?” That inquiry naturally leads to “How do I even use this information?” Of course, there’s the ever important “How do I know if it’s even working?” People also examine the value proposition by asking “What am I paying for in a financial plan?”

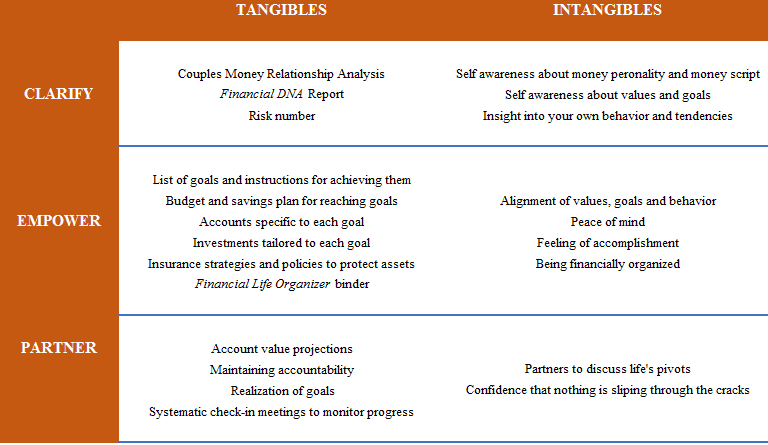

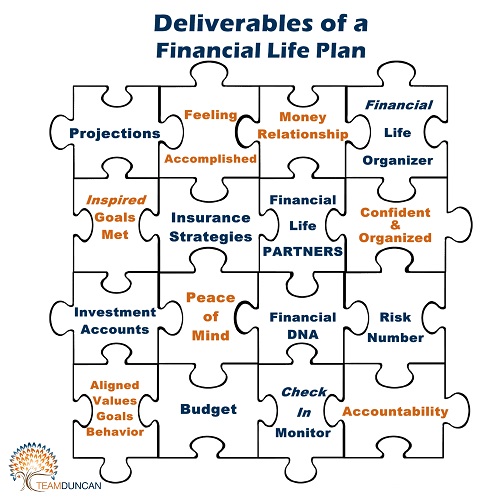

A Financial Life Plan looks different for every client because it’s built specifically for an individual client’s needs and money personality. A client who doesn’t have kids isn’t going to be saving for the goal of sending their child to college. It won’t be mentioned in their plan and they won’t open accounts or make investments aimed at this purpose. The small business owner has different insurance needs than the corporate employee with a generous benefits package. They will likely need policies that are very distinct from one another. Everybody’s life circumstances are different, leading to Financial Life Plans that look vastly different. However, there are some consistent tangible and intangible deliverables that come with establishing, enacting, and maintaining a Financial Life Plan.

First, let’s talk briefly about the Team Duncan Process and the Financial Life Plan. A Financial Life Plan is a roadmap with instructions to follow at each stage of your life so that you can meet your goals. First, we clarify your goals and uncover personal tendencies that might get in your way. This means exploring your values and whether they are aligned with your goals, your internal money script and personal biases that impact your financial decision making, and what your version of success looks and feels like. Next, we empower you to meet your goals by helping you implement your plan. Lastly, we partner with you through a lasting, long-term relationship where we hold you accountable for following the plan. Along this journey there are some tangible and intangible deliverables that you can take with you wherever you go. The largest intangible deliverables our clients receive is the feeling of achievement and peace that come with being organized and financially prepared.

Our initial step, Clarify, is mostly about intangibles. Intangibles may not have mass, but they sure do carry a lot of weight. Intangibles are the thoughts in our head and the feelings in our soul that can drive our behavior. Intangibles cannot be put down on a table or unloaded out of a pack. They are always with you. Self-awareness regarding your internal money script, money personality, values, and goals is an incredibly important deliverable of the Team Duncan planning process. Reaching this clarity about your internal drivers and learning to recognize when you’re working against yourself is key. The resulting insight is a valuable intangible deliverable.

Tangible deliverables are produced during most of our second step, Empower. This is where we position you to move toward your goals. Using the information about your goals and current financial situation collected during step one, we will produce your roadmap for achievement. Following the map’s instructions will yield many tangible takeaways. First, there is the budget and savings plan. How will you move towards saving $80,000 for your kid’s college education if you don’t map out a plan for setting aside that money? If you’re trying to get out of debt, how will you ever get ahead of the eight ball if you don’t figure out how much you’re spending each month and find places to cut back? Want to work every single day the rest of your life? Didn’t think so. There’s a line item in the budget for that, too. A budget and savings plan is a tangible set of financial instructions for living your daily life and is something that you will get from your Financial Life Plan. With the insight necessary to get out of your own way and a detailed set of instructions for traveling the path, you’ll be off to a good start.

In addition to clearly defined goals and instructions for getting there, you’ll need the correct types of accounts and investments that are suitable for each goal. College savings will differ from retirement savings. Vacation or boat savings are in yet another category. Add to the list of tangible deliverables all of the accounts we will assist you in opening, choosing the investments to live in those accounts, and managing and rebalancing those investments. Let’s not forget insurance strategies to protect all of these assets in the event something unexpected happens. These are all tangible items. The estate plan we’ll help you put in place that governs distribution of your assets if you pass? Also tangible. The peace of mind of having all of this in place falls into the intangible category. Three times every year, we will check in with you to review your goals, investments, and projections for whether you are on track. These projections are another tangible deliverable.

Working with a financial professional to construct a Financial Life Plan may seem nebulous and abstract at first. Perhaps that’s because it’s hard to find a “What to expect when you’re expecting [a financial plan]” type of list. Well, we hope this helps. At Team Duncan Financial, we pride ourselves on offering both the tangible and intangible deliverables that accompany our process.

We encourage you to start today by visiting our Team Duncan website and uncovering your money personality by using our free online resource: “Know Thyself: They Key Ingredient to Making Better Financial Decisions” or by reaching out by phone or email to schedule a free Discovery Experience.